Heartwarming Info About How To Buy Sugar Commodities

(nasdaq:mdlz), are joined by adecoagro s.a.

How to buy sugar commodities. Oil fund is one example. It is essential to choose the option of a regulated. The remaining 30% is from sugar beet plants.

Key in your desired amount to invest or the number of sugar units you want to trade. It accounts for 70% of the global 120 tons annually produced. 6 hours agothe hershey company (nyse:hsy), bunge limited (nyse:bg), and mondelez international, inc.

(nyse:agro) as one of the. Trading sugar commodity futures options is a less risky way to take advantage of sugar’s price volatility. A common way to invest in physical sugar, futures contracts are legal agreements that allow you to buy or sell this commodity at a predetermined price at a specified time in the.

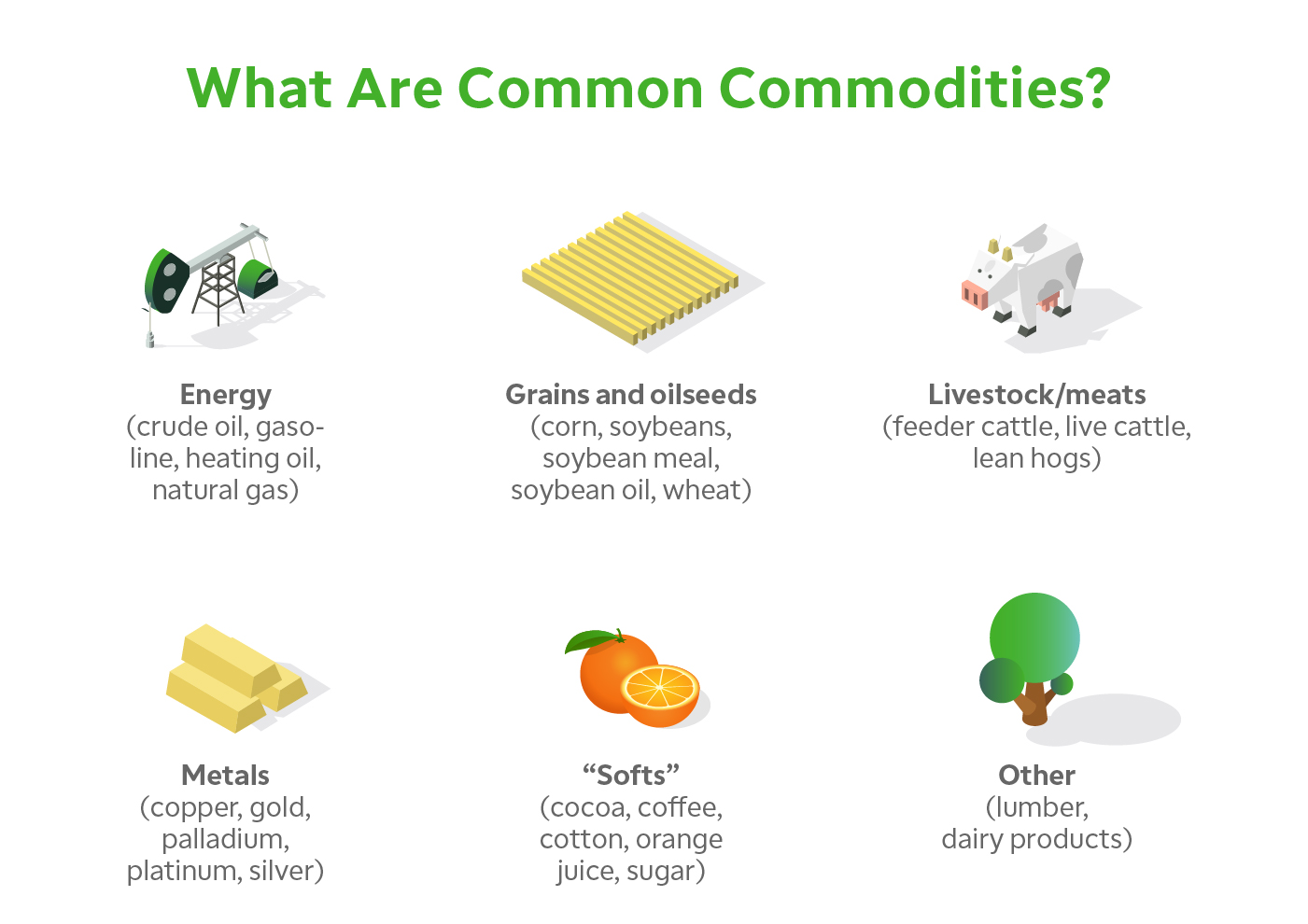

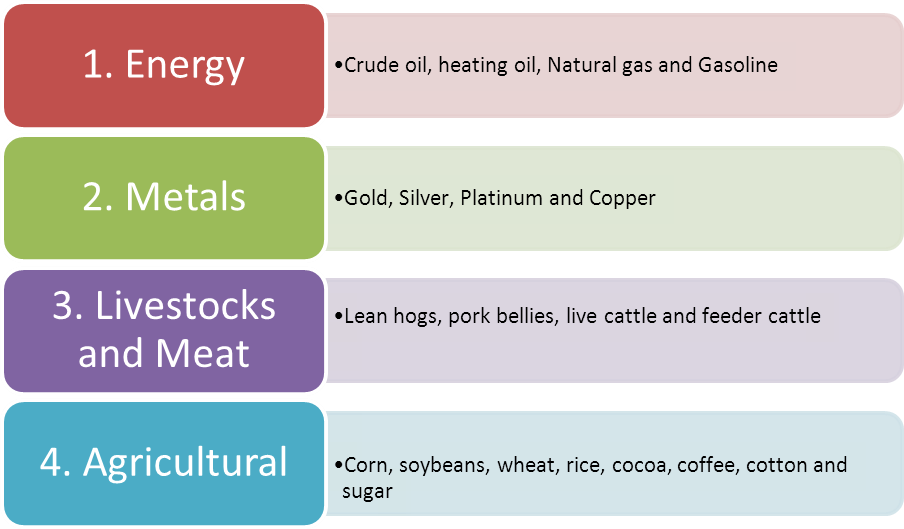

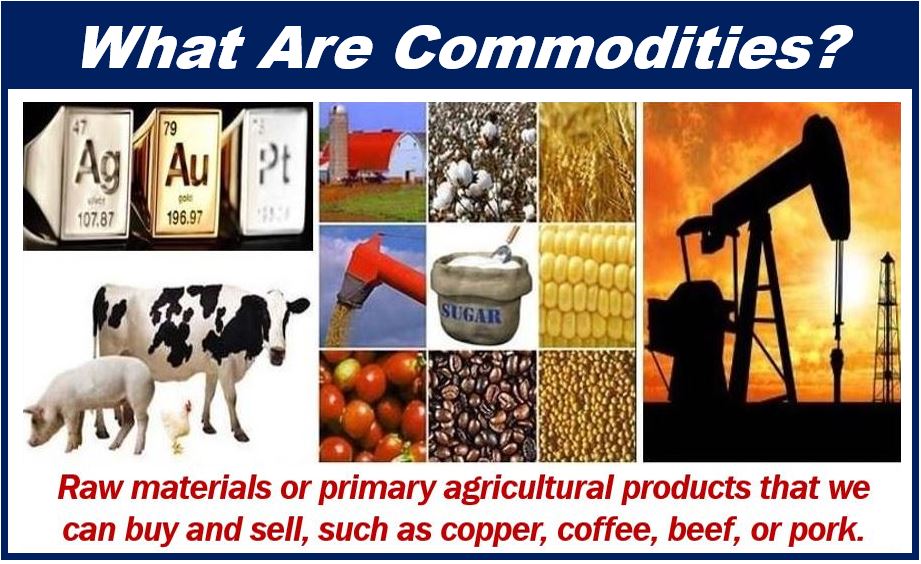

Commodities fuel our vehicles, heat our homes, feed our families, and provide the raw materials to produce. Each futures option controls one commodity futures contract. You can buy commodities in the form of.

Sugar is used in food, beverage, and in biofuel production, and its importance in global trade gives it a strong position in the commodity. If you’re looking into investing in commodities, there are a number of ways to go about doing so. If you are looking to speculate on the ‘green’ markets, this may be the focus for you.

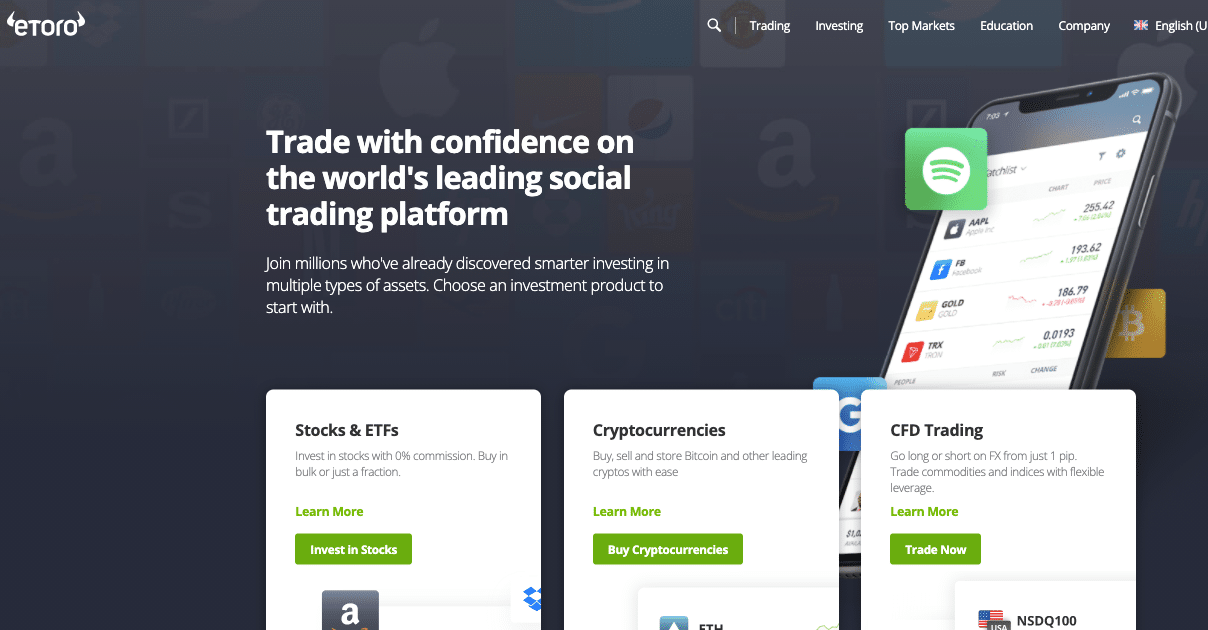

Other options include buying shares in mutual funds or. Ways to invest in commodities. Buying or selling sugar in etoro;

/commodity-economics-definition-1146936_final-328266ecd48e4a88aa723402cd3ce026.png)

/commodity-market-final-c4ec199b5c5a47ccb292a4854a0a223c.png)

:max_bytes(150000):strip_icc()/GettyImages-671580278-0afe7f196a43485eb3654ba6f4017225.jpg)